Escape the ICP Death Spiral

Or why chasing something big can keep your startup small.

The Next Founder helps founders build great startups. We offer advice on managing your mental health and productivity, hiring and managing great people, building a strong culture, and keeping people aligned and working on the right things. See the series overview at Welcome to The Next Founder and find out more about me at My Story.

“Focusing is about saying no. And you’ve got to say no, no, no. When you say no, you piss off people.”

– Steve Jobs

“The main thing is to keep the main thing the main thing.”

– Stephen Covey

“If you chase two rabbits, you will not catch either one.”

– Russian proverb

Right Under the Wire

Today is the last day of your fiscal year, and everything comes down to a customer meeting an hour from now.

You were at $1.5 million ARR when you closed your seed round last year, and growth since then has been solidly “mid.” You lowered the annual plan to $2.5 million and placated your board, assuring them that the new plan would at least be a slam dunk.

But “slam dunk” is now “half-court shot.” You’re at $2.2 million, and you won’t make the plan unless you close the $300K contract in the meeting.

The good news is that the customer told you they will sign today. The bad news is they’ll only sign if you agree to their list of demands. It’s not a sales meeting; it’s a hostage negotiation.

The customer is a health insurance company, an industry you don’t sell to. They won’t buy unless you build an integration with their proprietary medical records system, commit to HIPAA compliance, and offer user-based pricing instead of charging per transaction.

You and your co-founder agree you need to take the deal, even though it will suck up your engineering resources for a quarter and will create ongoing hassle for your finance team. Neither of you wants to roll into the next board meeting with the news that you missed your plan yet again. At best, the board will rant and rave. At worst, they’ll pull their support. You cave within the first five minutes of the meeting.

Later that night, as you lie in bed doom-scrolling, the purchase order arrives. You feel little joy as you scribble your digital signature. You lived to fight another day, but you worry you now have much larger problems looming.

The Goldilocks ICP

In Embrace Contradiction, we said a startup demands constant trade-offs. Some of the toughest involve who you sell to, or your “Ideal Customer Profile” (ICP).

Your ICP describes the customers who are the best fit for your product and whom you can reach and win in a repeatable and scalable way. An ICP typically includes the customer’s industry, size, geography, and factors such as their tech stack, risk tolerance, and urgency to solve the problem you solve.

A startup with a clear and focused ICP can:

Focus product development on precisely what those customers need.

Craft messaging and value propositions to appeal to those customers.

Build marketing channels that find those customers where they learn about products.

Build a community of customers who want you to succeed and refer other customers.

But even a startup that is clear on its ICP, like the one in our vignette, will feel pressure to chase non-ICP customers because of:

Challenging targets. Most founders set aggressive revenue targets and struggle to meet them, making it hard to say “no” to customers who want to buy (especially on the last day of the fiscal year!). Walking away from revenue feels odd when you’ve been scraping and clawing 80 hours a week to bring it in.

Fundraising. Investors seek startups tackling large markets, so founders feel pressure to describe a huge market they can sell to from day one.

Internal pressure. Your sales and marketing teams will always uncover prospects who don’t fit your ICP, and they’ll ask if they can try to close those deals. When you say, “no,” they’ll ask why you are paying them to close deals and then not letting them do it.

Learning curve. Even if your ICP is spot on, it always takes time for your team to learn to attract and win those customers. You won’t always know the difference between the normal sales learning curve1 versus the possibility that you got your ICP wrong.

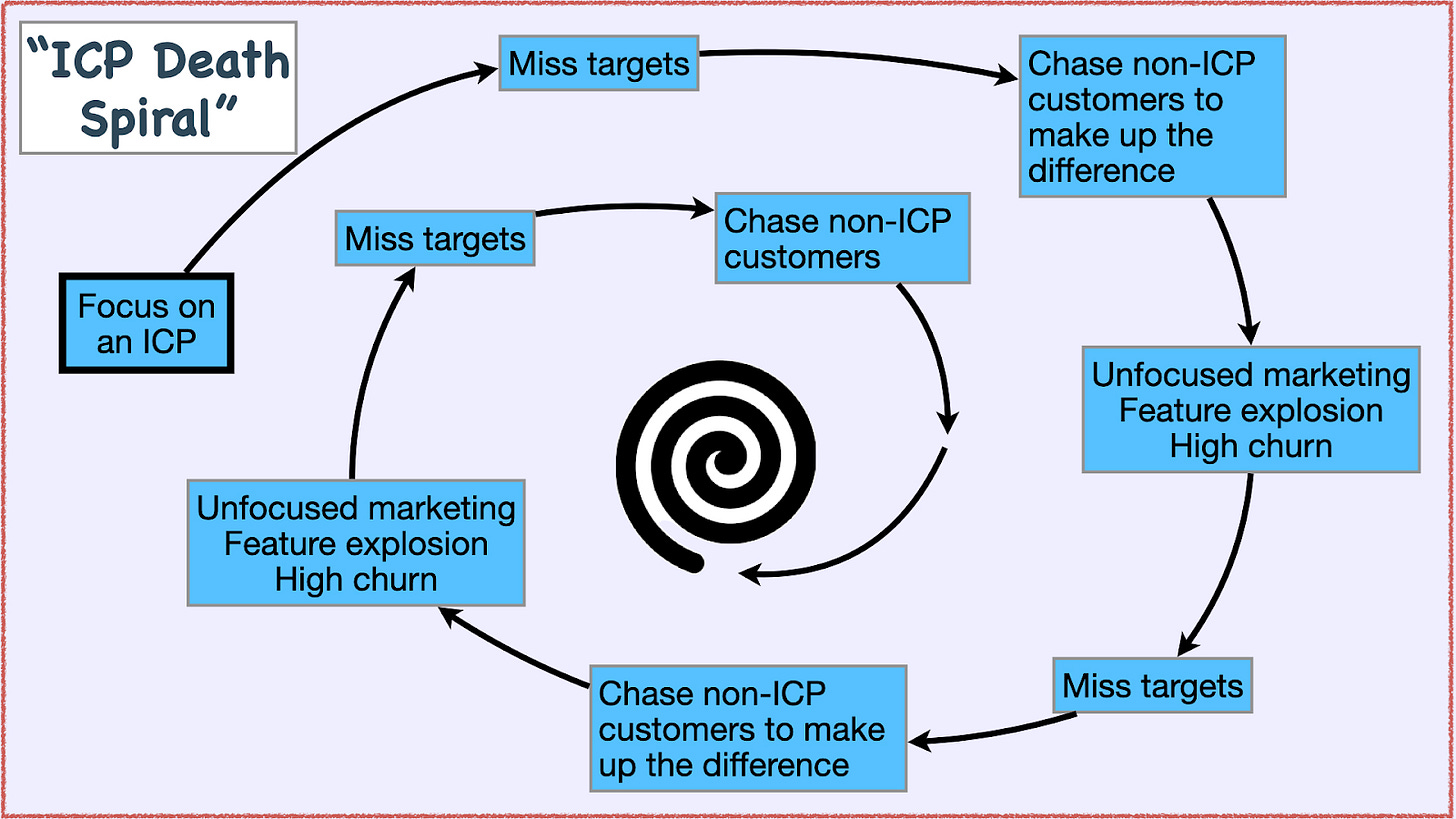

But chasing non-ICP customers can raise marketing costs, fragment your roadmap, reduce your win rate, and raise churn. That can lead to even more pressure to win deals, leading to the “ICP Death Spiral”:

On the other hand, a startup succeeds by being agile, scrappy, and responding to market feedback. Surely this sometimes means going after deals that aren’t perfect.

How do you know when to hold your ICP and when to fold?

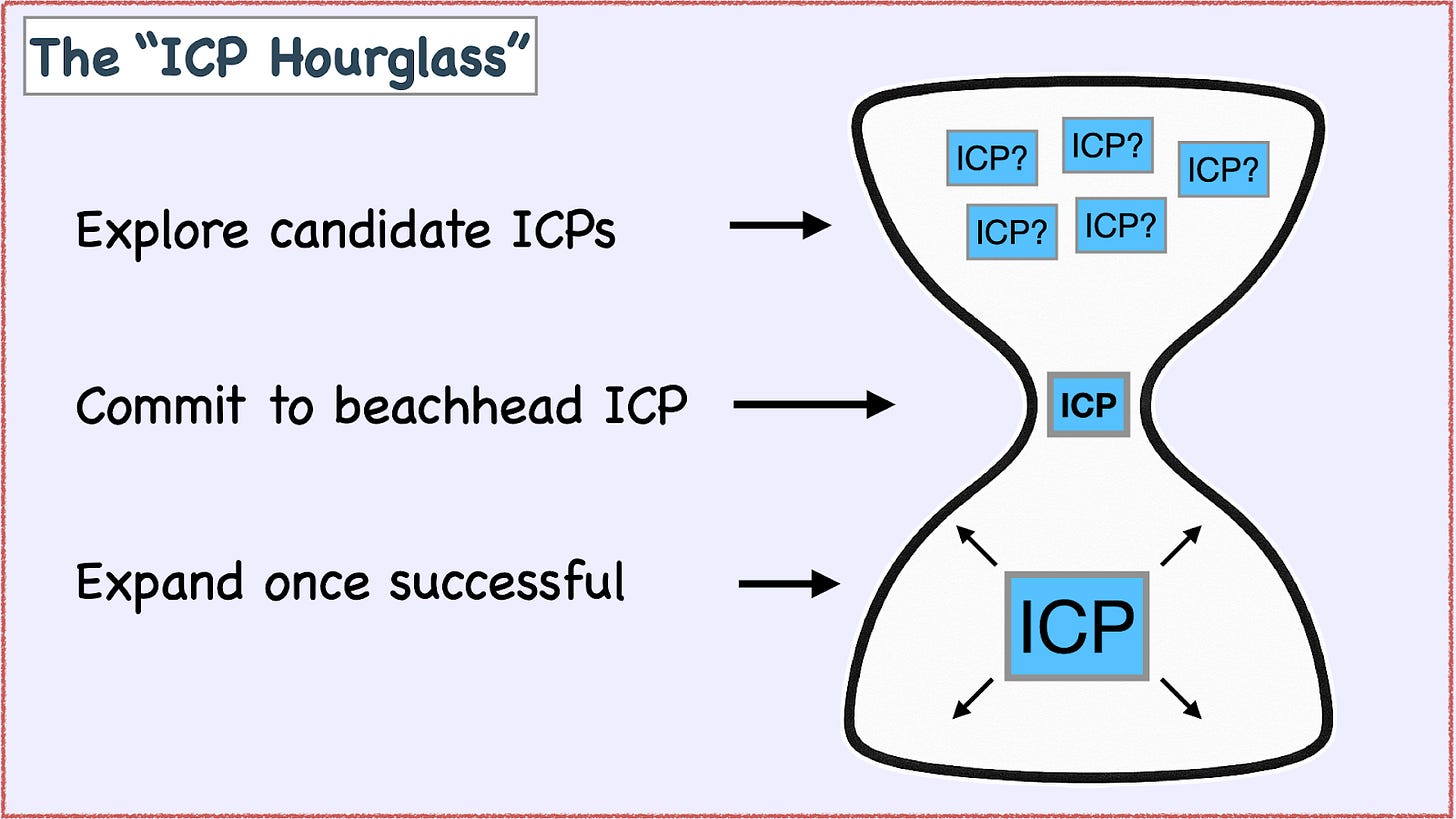

Navigate the “ICP Hourglass”

You can think of your startup as an hourglass, wide at the top, narrowing in the middle, and widening again at the bottom:

How you handle ICP decisions depends on where you are in the hourglass. Starting from the top:

Explore ICPs – Every startup begins as a hypothesis about an ICP, their problem, and your solution. That hypothesis is almost always wrong, so you might need to cast a wide net and test different ICPs and product features to identify a set of customers who feel your problem most urgently and are most ready to buy. This is your “beachhead ICP.”

Commit to a beachhead ICP – Once you find an ICP where you consistently grab customer interest, win, and solve their problem, you can double down on that ICP and focus your product development, sales, and marketing on it.

Expand ICP – Once you consistently hit your targets in that core ICP, you can make deliberate, gradual expansions into adjacent ICPs.

The hourglass also helps you solve the investor problem: communicating a bold vision to eventually address a huge market while showing a plausible plan to get started.

But once you settle on an ICP, how do you make it real?

Make Your ICP Stick

Your ICP isn’t an abstract strategy. It has to guide how you run the company day to day. You should:

Write down your ICP, train your team on it, and constantly remind them of it. Laminate it and stick it on the wall if you need to.

Tag every sales opportunity that enters your funnel as either ICP or non-ICP. Don’t allow your team to burn cycles on non-ICP opportunities, and don’t pay them on non-ICP pipeline.

Focus your messaging on your ICP. Your website, customer case studies, demos, and pitches should all speak to your ICP.

Develop marketing channels tailored to your ICP. Target ads to your ICP. Show up at the trade shows your ICP frequents. Work with partners that sell to your ICP.

Only build product features that win ICP deals and make them successful. Don’t let your sales team harass your product team to add features to chase non-ICP accounts.

If your team isn’t tired of hearing about ICP, you probably haven’t done enough.

Face the Real Problems

Let’s say you do everything described here but still end up like the startup in our vignette, feeling pressure to chase non-ICP deals. What do you do?

Before you cave, as our founders did, take a step back and ask why you find yourself in this predicament. You’re usually suffering from one or more of:

Not enough pipeline. If you find so few qualified ICP opportunities that you have to chase non-ICP ones, you may not have enough pipeline. Startups often need much more pipeline volume than founders realize.

No compelling messaging and value proposition. If you reach customers in your ICP but consistently fail to engage them, you might not have identified the messages and value proposition that resonate with them.

The product is not ready. If you successfully generate ICP prospects but lose to competitors or homegrown solutions, you may have a product problem. Identify what is missing and whether you can build it.

You got your ICP wrong. If the problem persists, you may have selected the wrong ICP and need to rewind and identify which of your assumptions were incorrect. Pop back up to the top of the ICP Hourglass, experiment, and see if new answers emerge.

No one cares about the problem you solve. Many startups are simply working on a problem that isn’t urgent for anyone at all, regardless of ICP.

How do you know which of these it is?

Before assuming it’s volume, ask: are ICP customers entering the funnel?

Before assuming it’s messaging, ask: do engaged ICP prospects convert?

Before assuming it’s product, ask: do converted customers stay and expand?

Compromise with Integrity

Well-funded startups have the freedom to turn down customers. Bootstrapped startups often don’t. Closing a non-ICP customer beats putting the next payroll on your personal VISA card.

But if you absolutely have to take the customer, make sure:

You are honest with your team. Don’t try to gloss it over. Explain why you decided to sell outside of ICP.

Avoid the slippery slope. Tell your team that it’s not open season on chasing any customer who answers the phone. Approve any ICP exceptions yourself.

Be honest about the cost. Don’t fool yourself into thinking that signing up the wrong customers is no big deal. Be honest about the cost of supporting the customer, and assume they will likely churn.

Ask why. Most of all, don’t just show up at work the next Monday, congratulating yourself on closing the deal. Ask why it happened and if you have bigger problems on the horizon.

Face Your Demons

Managing a startup is hard, but managing your psychology is even harder. Missing the number hurts. Disappointing the board is scary. Saying “no” to your team is uncomfortable.

But running in circles and never building a great company because you didn’t focus on an ICP will feel even worse.

But you’ll feel way worse if your startup languishes because you were never willing to pick an ICP and go all in on it.

If you have feedback or suggestions for future posts, please comment or contact us at michael@nextfounder.co.

Mark Leslie’s Sales Learning Curve still holds up well today.

Great piece, Mike! I was recently chatting with a CEO about the importance of determining ICP and the "ICP hourglass" is a great way to communicate how ICP evolves over time as the business grows.